Airtel Money has announced a groundbreaking partnership with Juba Express, a licensed international payment service provider, to launch seamless cross-border money transfer services. This new offering is designed to tackle the high cost of remittances while providing easy and affordable international money transfers directly through the Airtel Money wallet.

According to the World Bank’s 2024 Migration and Development Brief, remittance inflows to Sub-Saharan Africa reached USD 54 billion in 2023. Uganda received approximately USD 1.2 billion, a number that grew to USD 1.42 billion by January 2024. These funds are essential for supporting household expenses, education, healthcare, and small business investments across the country.

This new Airtel Money-Juba Express service directly addresses the high cost of sending money abroad by offering low-cost, real-time international transfers with transparent forex rates and simplified access through Airtel Money’s USSD menu. To access the service, users simply dial 185# → Send Money → International Transfers → Juba Express.

Key Features of the Airtel Money-Juba Express Service:

- Global Reach: Send money to over 120 countries directly to any wallet or bank account.

- Affordable Pricing: Low forex rates and transfer fees starting from UGX 120, with transactions of up to UGX 5 million.

- Instant Access: Access the service instantly via Airtel Money’s USSD 185#.

- Secure & Regulated: Powered by licensed provider Juba Express and regulated by the Bank of Uganda.

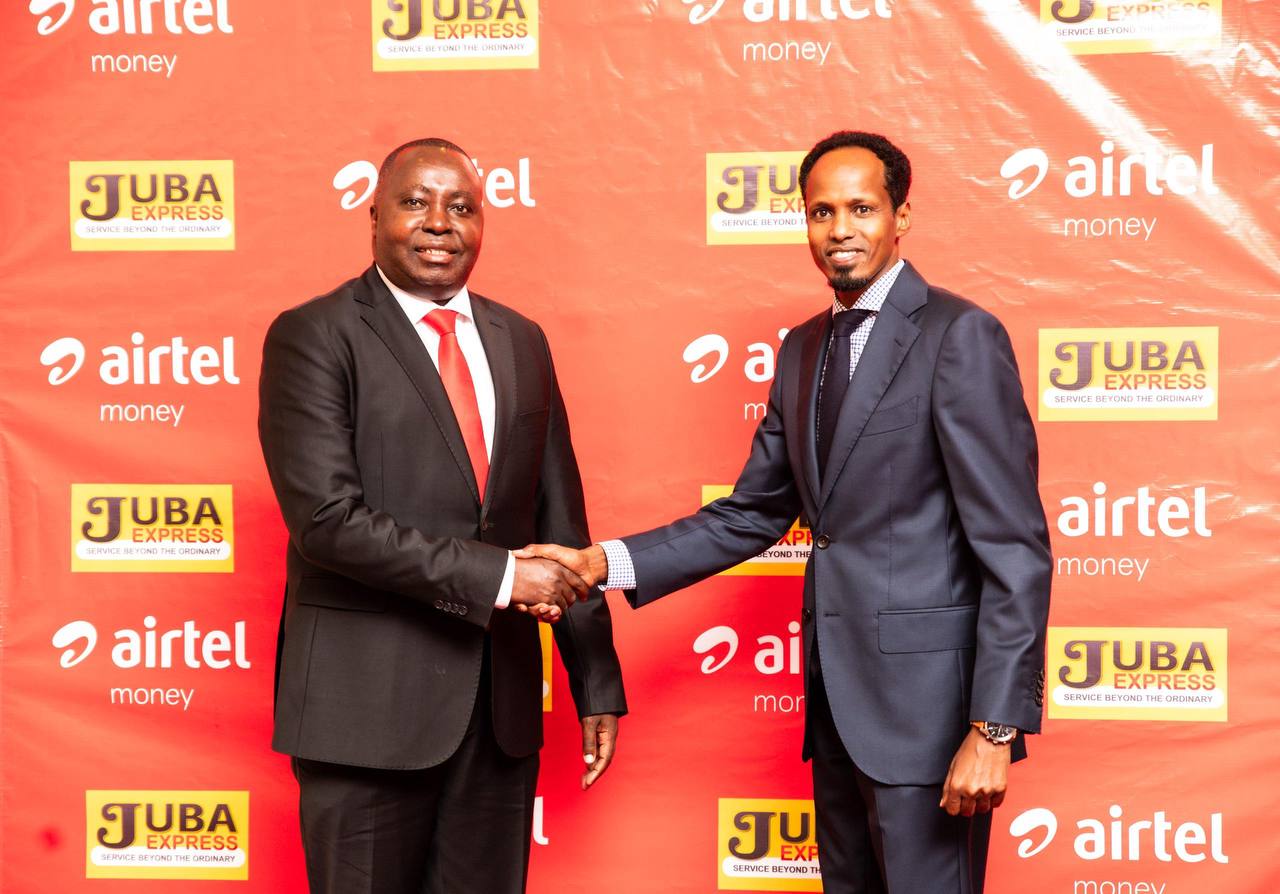

Japeth Aritho, Managing Director of Airtel Money, highlighted the importance of this new service, especially in today’s interconnected world. “Cross-border transactions are more critical than ever. Whether it’s for family support, paying school fees, or business transactions, these payments are the lifeblood of our global community,” he said. Aritho added, “With Juba Express, we are expanding Airtel Money beyond borders, making international transfers faster, safer, and more affordable for our customers.”

Sitati Dawo from Juba Express also emphasized the significance of the partnership in promoting financial inclusion and expanding access to global opportunities. “Partnering with Airtel Money allows us to extend our mission to millions of Ugandans, enabling them to support loved ones, grow businesses, and engage with the global economy more confidently,” Dawo explained.

This collaboration enhances Uganda’s position as a leader in digital financial innovation. The integration of Juba Express into Airtel Money ensures that every Ugandan, regardless of location, can participate in the global economy with ease.

Conclusion

The new Airtel Money-Juba Express partnership is set to revolutionize the way Ugandans handle cross-border money transfers, making them more affordable, accessible, and efficient. By offering a unified platform that supports international payments with low fees and real-time access, Airtel Money continues to push the envelope in providing inclusive financial solutions for its customers.